TOKYO, Nov 25 (News On Japan) - The Nikkei Stock Average climbed into the 52,000-yen range in October before swinging sharply and falling back below 50,000 yen, raising questions over whether the benchmark has already entered a correction phase or whether the market can stabilize above the 50,000-yen level and aim higher.

With investors increasingly focused on the trajectory of AI-related stocks, Hiroki, chief strategist at Monex Securities, offered guidance on how retail investors should navigate the volatile environment.

After Kouichi became LDP president on October 4th, the Nikkei extended a strong rally that carried it to 50,000 yen for the first time on October 27th, briefly touching the 52,000-yen level. However, the index has since turned downward, closing at 48,625 yen on Friday last week. As geopolitical risks heighten and market sentiment weakens, attention has shifted to where equities may head next.

Hiroki, who previously served as a fund manager at multiple domestic and overseas asset management firms, noted that the surge following Kouichi’s victory was amplified by strong gains in U.S. AI-related shares. The rally spread to Japan, with stocks such as SoftBank Group, semiconductor testing giant Advantest, and Tokyo Electron powering much of the Nikkei’s rise in October. Because of the index’s calculation methodology, just these three companies accounted for roughly 5,000 yen of the nearly 7,000-yen advance from the 45,000-yen level to above 52,000 yen, creating what Hiroki called an “extremely skewed” market structure that has since begun to correct.

While the Nikkei has dropped noticeably, the broader Topix, which tracks all Prime Market constituents, has not fallen nearly as sharply. Hiroki attributed the difference to the outsized influence of AI-related heavyweights on the Nikkei. As concerns over an “AI bubble” intensified in November, the selling pressure focused squarely on those names. This dynamic pushed the NT ratio, which compares the Nikkei to the Topix, sharply higher, reflecting a correction of the Nikkei’s earlier overextension.

Internationally, the debate over whether AI stocks are in bubble territory has grown louder. Michael Burry, the investor known for predicting the global financial crisis, has warned of excessive speculation, and shares of Oracle, which recently announced major data center investments, have also weakened. Still, Hiroki argued that labeling the current market a bubble is difficult. He said that valuations of key AI names such as Nvidia are elevated but not necessarily detached from fundamentals, given the company’s enormous profits.

Rather than stock prices alone, Hiroki pointed to excessive investment in data centers and related infrastructure as the core risk. Research teams at think tanks and financial institutions have raised alarms that the scale of capital being poured into AI may not be fully recoverable. Another troubling factor is the rise of financing arrangements within AI-related ecosystems, where large IT companies, chipmakers, and AI developers provide funding to one another in complex loops reminiscent of vendor financing during the IT bubble. Hiroki said this structure evokes the “unsettling” dynamics seen both in the late-1990s tech bubble and in the run-up to the 2008 financial crisis.

However, he also emphasized that unlike the subprime-loan era, the financial system is not deeply entangled in these flows, making a global credit crunch akin to the Lehman Shock highly unlikely. Still, major IT companies have begun issuing corporate bonds to raise cash, which Hiroki described as “somewhat concerning.”

If the AI boom were to collapse, Hiroki expects the impact to be concentrated in stocks directly tied to the sector. But he warned that declines could still be steep. Given that the Nikkei rose by around 7,000 yen in just one month, he said a drop of 8,000–9,000 yen from current levels would not be surprising. A fall below 40,000 yen is possible, he noted, pointing to the sharp decline seen during the “Trump Shock” earlier this year when the index retreated from the 40,000-yen range to the 30,000-yen level in a short span.

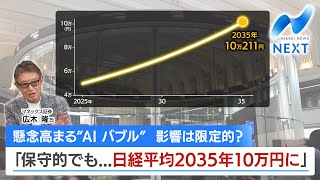

The program then paused for a break, promising to examine when the Nikkei might return to 50,000 yen and whether it could eventually reach 100,000 yen.

Source: テレ東BIZ